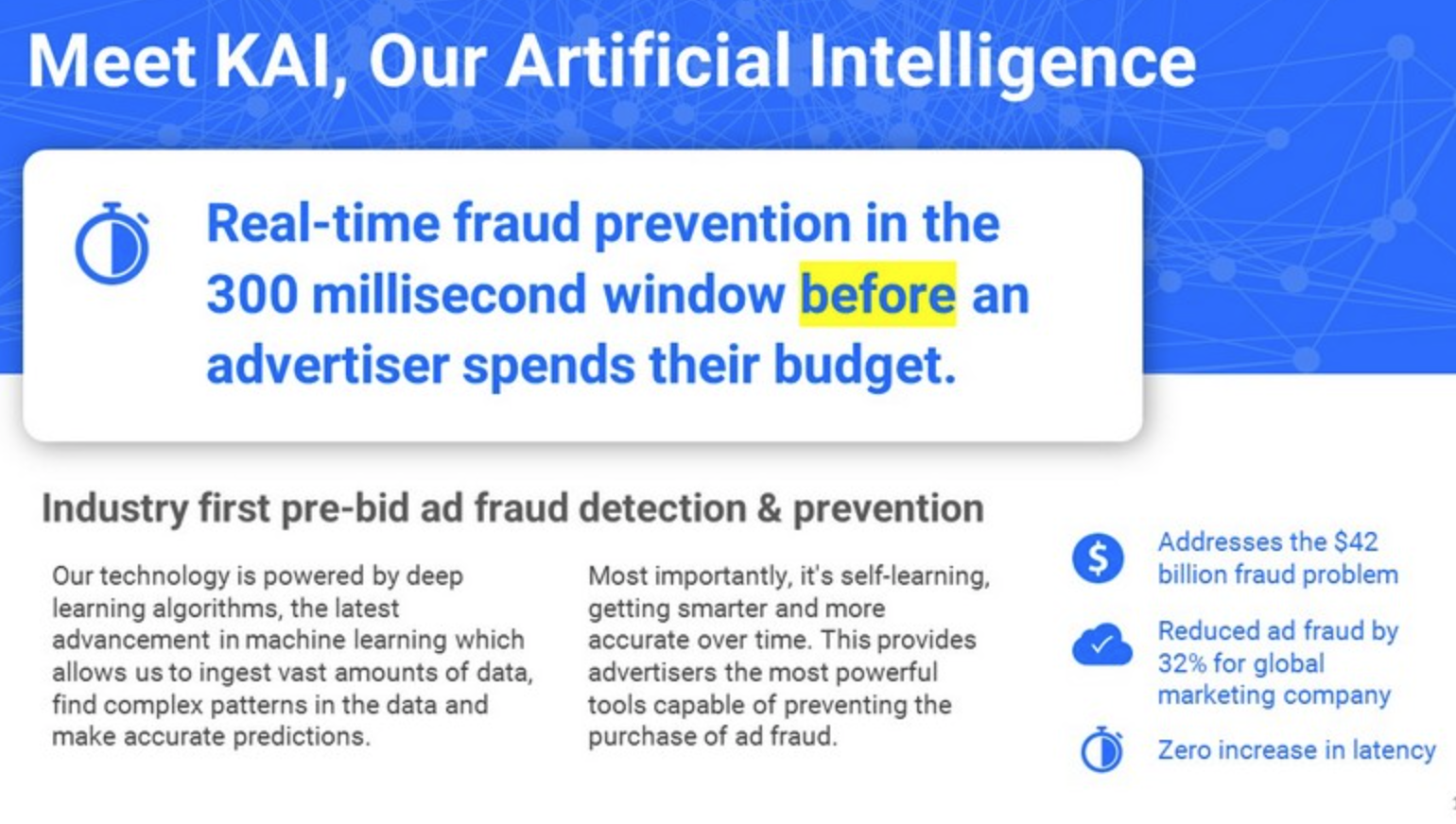

A page from Kubient’s July 2020 prospectus for its initial public offering (IPO), making a few bold claims about the firm’s technology that would later factor into federal prosecutors’ charges.

Credit:

SEC

Before Kubient’s IPO in August 2020, Kubient issued a prospectus noting research figures that suggested $42 billion lost to ad fraud in 2019. Kubient’s technology was touted as fast enough to work in the 300-millisecond real-time ad auction window. It leveraged “machine learning powered [sic] pre-bid ad fraud prevention technology” and a “self-learning neural network always getting smarter.”

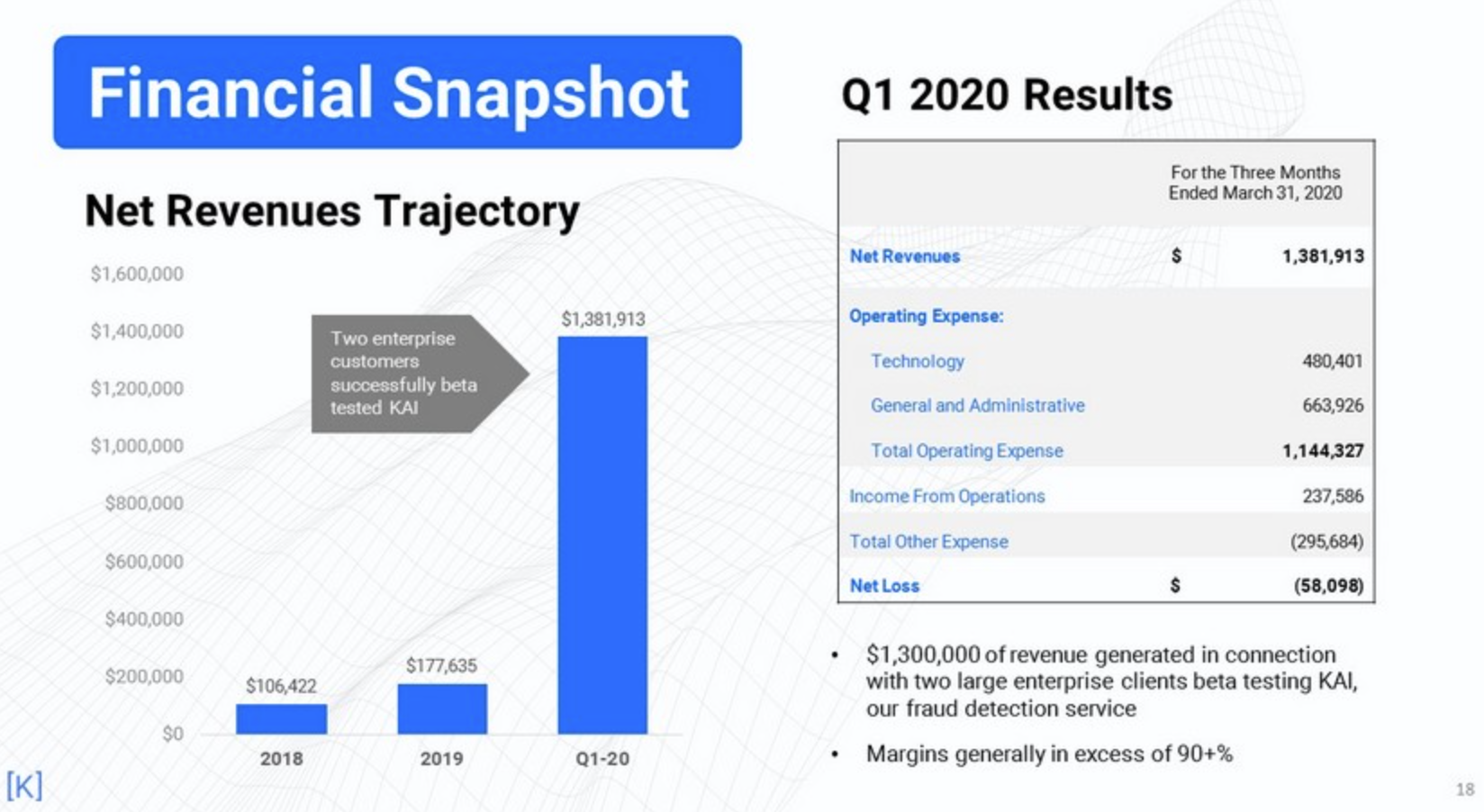

Revenues for the first quarter of 2020 were shown as $1.38 million, a huge jump from $177,635 in Q1 2019, thanks to “two enterprise customers” that “successfully beta tested KAI.” Prosecutors noted at the time of Roberts’ plea that he personally added language that Kubient was “identifying and preventing approximately 300% more digital ad fraud” than a client’s current ad partners. Kubient raised more than $33 million during its initial and secondary equity offerings.

Investigations by the Securities and Exchange Commission, US Postal Inspection Service, and the US Attorney’s Office for the Southern District of New York led to charges against Roberts in September 2024. Joshua A. Weiss, Kubient’s former chief financial officer, and Grainne M. Coen, a former audit committee chair, were also charged at the time.

Roberts, 48, faced up to 20 years in prison on a single charge of securities fraud. He will be subject to one year of post-release supervision after serving his term.

Kubient, which was reported to be in Chapter 7 liquidation proceedings at the time of Roberts’ plea, was announced as merging with Adomni and taking on the Adomni name in May 2023.