In a nutshell: Intel’s decision to maintain a multi-foundry approach reflects the practical necessities of collaborating with external suppliers. While the company remains committed to achieving fabrication self-sufficiency one day, this goal is now balanced against product competitiveness and time-to-market considerations.

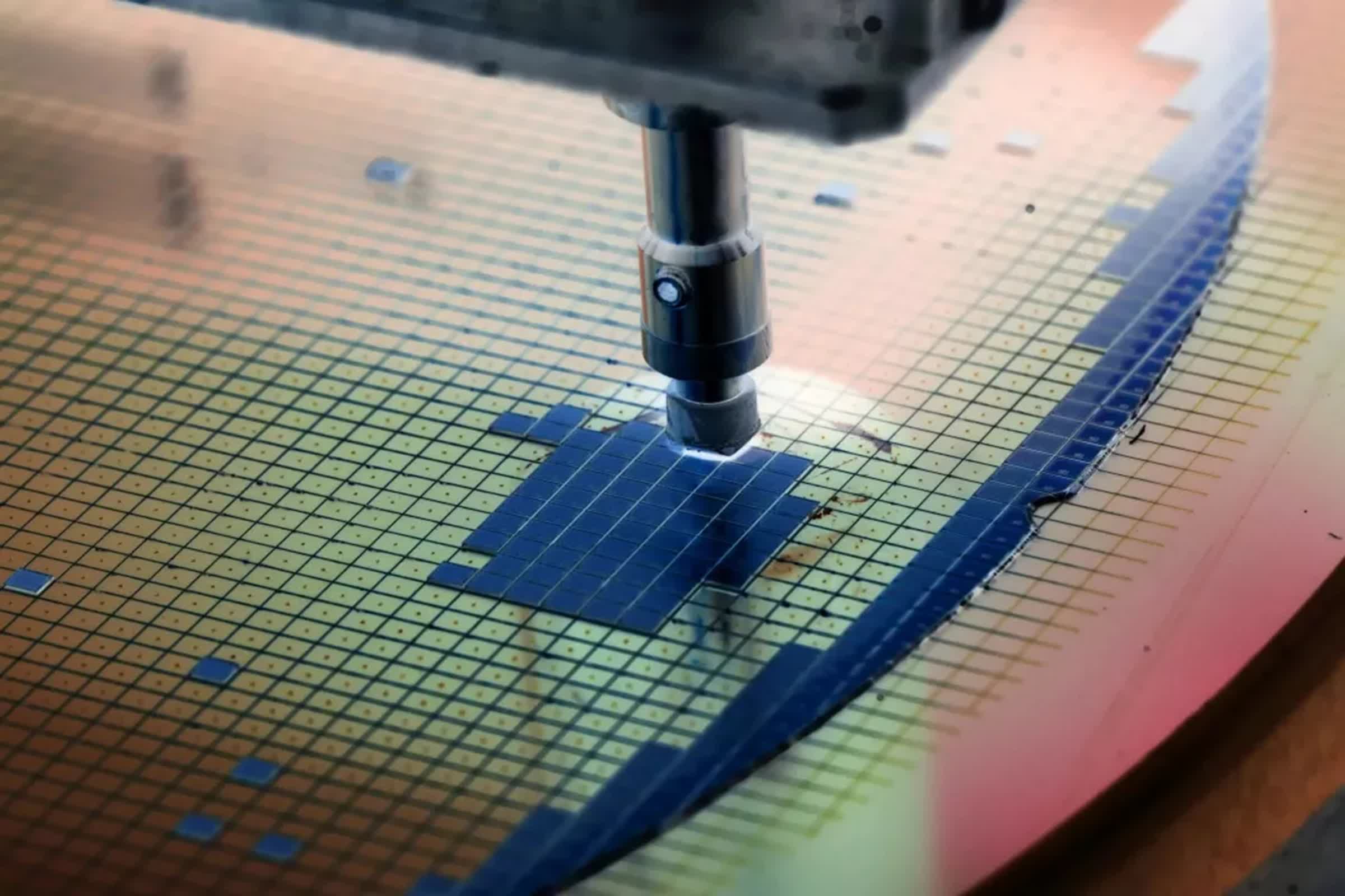

Intel’s semiconductor manufacturing strategy has undergone drastic changes over the past few years, reflecting both historical trends in the industry and the company’s shifting priorities. Once committed to eliminating its reliance on external foundries – a goal rooted in its long-standing identity as an integrated device manufacturer (IDM) – Intel has now embraced a permanent multi-foundry approach, outsourcing approximately 30 percent of its wafer production to TSMC.

According to Intel’s VP of Investor Relations, John Pitzer, the company now views TSMC as a valuable supplier that fosters healthy competition with Intel’s own foundry operations. During a recent investor dialogue with Morgan Stanley analyst Joe Moore, Pitzer said that this partnership is seen as beneficial for maintaining product competitiveness and ensuring strategic flexibility.

“… to the extent that I think a year ago, we were talking about trying to get that to zero as quickly as possible. That’s no longer the strategy. We think it’s always good to have at least some of our wafers with TSMC. They’re a great supplier. It creates a good competition between them and Intel Foundry.

Not quite sure what the right sort of level set is. Is it 20? Is it 15? We’re working through that. But we will use, I think, external foundry suppliers longer kind of under this new strategy.” – John Pitzer, Intel’s VP for Investor Relations.

This shift in strategy coincides with leadership changes at Intel, where interim CEOs Dave Zinsner and Michelle Johnston Holthaus have been granted more decision-making authority. Holthaus likely has more authority to extend Intel’s reliance on TSMC and use it for a broader range of products than she might have six or nine months ago, Pitzer said.

Now, the company is evaluating an optimal outsourcing ratio, targeting between 15 percent and 20 percent of total wafer production – a level that would allow it to leverage external expertise without undermining its IDM model.

By relying on TSMC’s mature 3nm and 2nm nodes for critical products such as Arrow Lake processors, Intel ensures high-quality production while advancing innovations like Foveros 3D packaging technology.

The executive team is focusing on enhancing Intel’s product competitiveness before fully optimizing its foundry operations. Holthaus has also been given more agency to make decisions regarding the product roadmap and strategies for increasing market share.

For Intel, partnering with TSMC ensures access to advanced technologies and positions it competitively against rivals like AMD and Nvidia, which rely heavily on external foundries, all while working on potentially becoming a foundry provider for those same competitors in the longer term.